Agribusiness has been the driving wheel of the Brazilian economy. The constant improvement of agricultural activity positions the country as one of the world powers in the field and ranks it as one of the largest producers and exporters of various products. In 2020, agribusiness represented 26.6% of the national GDP according to Cepea (Center for Advanced Studies in Applied Economics), adding approximately R$ 2 trillion, which sustained the Brazilian economy during a period of crisis.

Despite the participation of Agribusiness in the Brazilian GDP is almost reaching 30%, on the stock exchange the numbers are much more discreet, not reaching 5% of market share.

When analyzing ESG indexes, this participation is even smaller. The main national and international ESG indexes are essentially composed of companies from other sectors, largely due to the small exposure of agribusiness on the stock exchanges. In addition, ESG Agribusiness indexes, such as the MSCI Agriculture & Food Chain, are mostly composed of large food chains (Nestle, Mondelez, Danone, Sysco etc.) and fertilizer companies (Nutrien, CA, and Corteva, US).

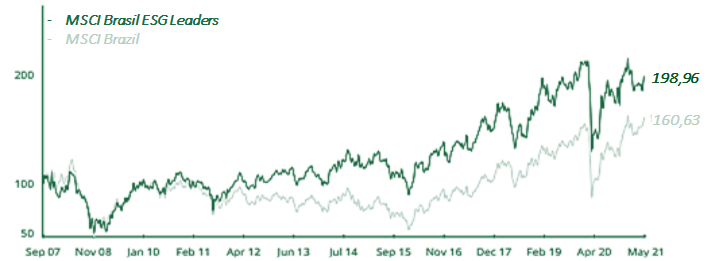

CUMULATIVE INDEX PERFORMANCE – PRICE RETURNS (BRL)

(SEP 2007 – MAY 2021)

Thus, the focus on the issue of sustainability in agriculture comes largely from small to large privately held companies, with a few exceptions: Bunge, Mosaic Fertilizantes, SLC Agrícola and Jalles Machado. The first two are renowned multinationals while the last two are national companies, with SLC having appreciated 580% since its IPO, and Jalles machado having debuted on the stock exchange in February 2021 (+26%).

In addition to the potential for good environmental practices, the sector has been standing out in governance and social issues. A survey by Great Places To Work (GPTW) interviewed 65 thousand agribusiness workers and the results found were expressive. 93% of the participants declared that they are proud to belong to the company they work for, while 91% demonstrated that their values are in line with those of the company they work for.

Regarding the financial result, GPTW highlighted that the average return of Agri-companies evaluated in the survey was 15% against 8% of companies listed on the stock exchange in the period between 2014 and 2020.

On the other hand, there is still a bottleneck in the countryside: gender inequality: women represent only 28% of the workforce. If leadership positions are considered, the numbers are even more alarming, with a female participation of 23% in the average leadership position and 11% in executive positions.

The Agribusiness scenario is positive and tends to remain in the spotlight in the near future. Therefore, we are seeing a growth of agri-companies on the stock exchange. In 2021 alone, three companies went public on B3: Jalles Machado JALL3, a sugarcane producer, Boa Safra Sementes, SOJA3, a seed producer, and Três Tento, TTEN3, seeds and fertilizers. The Sugarcane Technology Center (CTC), in Piracicaba (SP), is in line, as is the Companhia Mineira de Açúcar e Álcool (CMAA). The good moment for agro should further boost the number of agro companies in the market, which is beneficial both for this industry and its strengthening, increasing its funding capacity, as well as for investors who will have more options available for investment and diversification.

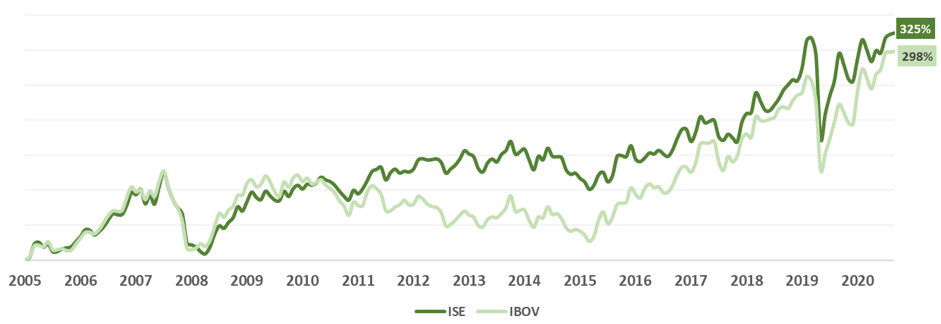

CUMULATIVE RETURN (ISE X IBOV)

A company focused on agribusiness linked to an ESG agenda can be considered a differentiator nowadays and, soon, it may be a basic need. Adopting practices consistent with the agenda often requires a cultural change of the organization in a sector that coexists with a very varied population, from a deeply technological and modern international vanguard to individual or family producers who are now having the first contact with some sustainability concepts. However, soon, only those companies that take responsibility for what is around them and seek to deliver value to the corporate group will be qualified to compete at the height and deliver consistent results or access international markets, whether in raising funds to finance production or in the search for new markets.