Over the past 20 years Brazil has faced several fiscal, social, political, and economic difficulties. Due to the global recession and pandemic, economic uncertainties will still impact and scare the world within the next years. Brazilians are more than used to be living in a country where long-term inflation is high and interest rates are tools to control it.

So, what about institutional investors, ultra-high net worth individuals and Family Offices in this scenario?

They can take advantage of fixed income products in the short and medium term whenever there is an increase in real interest rates, but the problem is in the long term. In a country where inflation tends to be increasing and with high volatility, there is a derivative in the capital market that can take advantage of this, delivering positive results to the investor, mitigating several risks and thus serving as a hedge for this investor who cannot put all his eggs in one basket. These products are the alternative funds, especially those aligned with the Private Equity segment.

According to the Cambridge Associates U.S. Private Equity Index¹, the private equity industry has generated average annual returns of 10.48% over a 20-year period from 2001 to 2020 while the Russell 2000 Index, a performance tracking indicator for small companies, averaged 6.69% per year over that period, and the S&P 500 returned 5.91%. Not surprisingly, according to Preqin², the private growth market went up from about $15 billion in 2000 to almost a trillion dollars by 2021.

In Brazil, ABVCAP³ has done the same study and found similar results to those found abroad. The graph below shows the return of private equity and venture capital funds compared to the results of BOVESPA Index, CDI, and the MSCI Index for emerging countries between 2004 and 2018. Starting in 2005, private equity funds outperformed the CDI and IBOVESPA every year and at least matched the MSCI EM.

Long-term capital gain products, which do not provide as much income over the period but invest in real assets that outperform inflation over the years, mitigate several actuarial risks of a portfolio and at the same time gift an investor with outstanding results over inflation. As Warren Buffett said “The market is a machine that transfers money from the impatient to the patient”

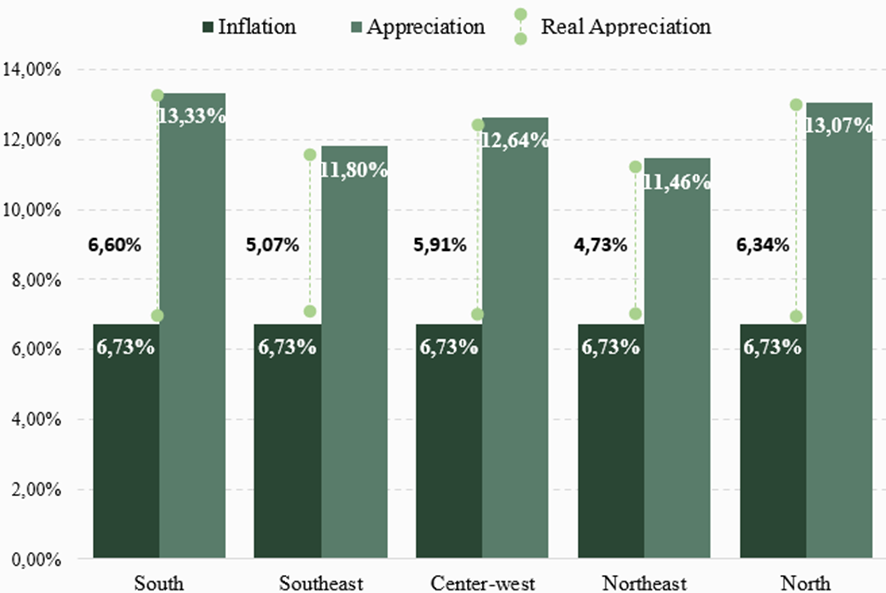

Looking at the farmland market in Brazil, we have a perfect example of what was said above.

Over 20 years, farmland in Brazil (pasture, crops, forest, etc.) has appreciated in value throughout the country, above its consumer price index, by an average of 5.73 percentage points. In other words, the asset mitigated the risk of currency depreciation and delivered results for the long-term investor in a country where inflation is substantial. An active management could deliver even more satisfactory returns, such as the strategy of farmland transformation, ILPF integration, or even leasing to third parties, specialists in farming.

And it is with the mix of competence in farm management and patience for asset development that AGBI applies in its business strategy. With more than 10 years of experience in agribusiness, we know that converting pasture to crops takes time, and that it takes years for the newly transformed farmland to reach its peak productivity. With two investment vehicles already divested and assets (farms) transformed and sold, we know that the wait is fruitful, and in this inflated country who has capital gains in the long term is King.

¹ – Cambridge Associates is the owner of the Private Equity benchmark and is responsible for data collection, benchmark generation, data security and confidentiality.

² – Preqin is a private investment data company that provides information as well as tools to support investment in alternative assets.

³ Brazilian Private Equity and Venture Capital Association is a non-profit entity that aims to develop the long-term investment activity in the country, in the modalities covered by the concepts of private equity, venture and seed capital.

Picture: https://br.freepik.com/fotos-vetores-gratis/lavoura