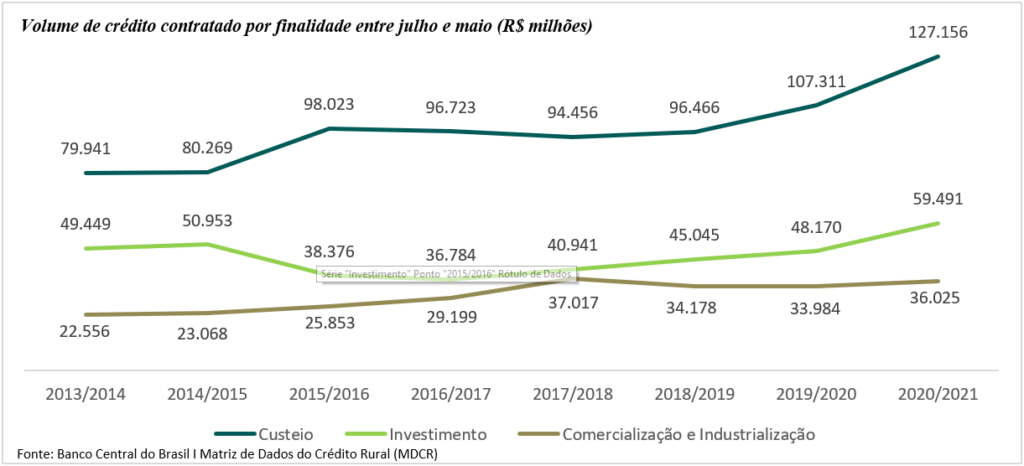

The release of rural credit through the Crop Plan reached a total of R$ 233.9 billion in the period from July 2020 to May 2021, according to the Agricultural Financing Balance Sheet for the 2020/2021 Crop. The amount represents an increase of 19% compared to the same period of the last harvest. This amount includes R$ 17.7 billion from contracts with the LCA source for discounting CPR’s and operations with Agroindustry.

According to the Ministry of Agriculture, Livestock and Supply (MAPA), the 2020/21 “Plano Safra” programmed R$236.3 billion for small and medium-sized rural producers, with interest rates lower than the rates of previous periods, which made it possible the 30% expansion in investments in rural production. These amounts still tend to be exceeded, as the balances of investment programs and other interests, not yet contracted, will be carried out after authorization for the reopening of the lines by the National Treasury Secretariat.

In addition to the good performance of the “Plano”, the “Lei do Agro”, which helps reduce bureaucracy in agricultural credit, completed one year in April and continues to contribute to reducing market interest rates. The new law has been heating up the demand for Rural Product Certificates (CPR). Between July 2020 and May 2021, the stock of CPRs included in B3 went from R$17 billion to more than R$40 billion.

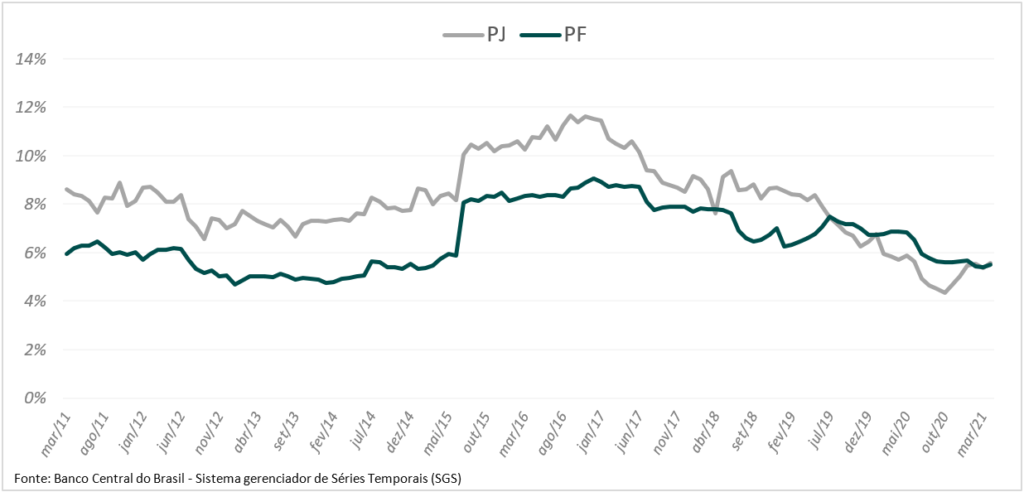

Both the “Lei do Agro” and the 2020/21 “Plano Safra” had a positive impact on the interest rate in the rural sector, bringing down rates for individual rural producers and companies. According to the Central Bank of Brazil, the average rate of rural credit for individuals fell from 6.9% in April 2020 to 5.5% in April 2021, a reduction of 1.4 percentage points, while the rate for companies rose from 5.7% to 5.6% in the same period.

Still with the panorama of uncertainties caused by the coronavirus pandemic, the contraction of rural credit for funding continued to grow in 2021, again with emphasis on the contraction of credit for funding via public banks.

All purposes had an increase in the value of rural credit contracts, compared to the same period of the 2019/2020 harvest.